Los CFD son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 76 % de las cuentas de inversores minoristas pierden dinero al operar con CFD con este proveedor. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse asumir el alto riesgo de perder su dinero.

Los CFD son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 76 % de las cuentas de inversores minoristas pierden dinero al operar con CFD con este proveedor. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse asumir el alto riesgo de perder su dinero.

La energía limpia es el futuro: Oportunidades en el trading y la inversión

¿Por Qué los Inversores Globales Están Apostando por la Energía Limpia?

En los últimos años, la energía limpia se ha convertido en uno de los temas de inversión más candentes a nivel mundial. Impulsada por políticas gubernamentales, la transición energética global y el rápido crecimiento de las empresas tecnológicas que apoyan un futuro bajo en carbono, invertir en acciones de energía limpia ya no se trata solo del impacto ambiental. Ahora se ha convertido en una oportunidad convincente para obtener rendimientos a largo plazo que los inversores de todo el mundo siguen de cerca.

| Puntos Clave |

-

Las acciones de energía limpia como Tesla, Enphase y First Solar están ganando impulso, impulsadas por políticas de Cero Neto y el aumento de la demanda de energía alternativa.

-

Los ETF de energía limpia como ICLN y TAN ofrecen una opción sólida para los inversores que buscan diversificar sus carteras.

-

Este sector tiene una alta volatilidad, lo que lo hace más adecuado para estrategias a largo plazo como el DCA, o para traders que analizan puntos de entrada y salida a corto plazo.

-

Las empresas involucradas en créditos de carbono o soluciones energéticas basadas en blockchain—como Power Ledger—podrían presentar nuevas oportunidades en el futuro.

-

Invertir en energía limpia es tanto una oportunidad para generar rendimientos como una forma de apoyar un mundo más sostenible a largo plazo.

Estrellas Emergentes del Mercado Global de Energía Limpia en la Era de la Transición

Las acciones de energía limpia—que abarcan solar, eólica, baterías y sistemas de almacenamiento de energía—están captando una fuerte atención de los inversores en todo el mundo. Ejemplos incluyen:

-

First Solar (FSLR): Un fabricante líder de paneles solares en EE. UU.

-

Enphase Energy (ENPH): Un pionero en microinversores y sistemas de almacenamiento de energía

-

SolarEdge (SEDG): Un desarrollador de soluciones integradas de energía limpia

-

Tesla (TSLA): Más allá de los vehículos eléctricos, la empresa también participa en negocios de energía solar y baterías

Estas empresas están siendo impulsadas por políticas de Cero Neto, incentivos gubernamentales (como la Ley de Reducción de la Inflación de EE. UU.) y la creciente demanda global de energía alternativa.

¿Deberías Elegir Acciones de Energía Limpia Individuales o Optar por ETF?

Para los inversores que desean diversificación sin la necesidad de elegir acciones individuales, los ETF de energía limpia ofrecen una opción conveniente y accesible. Estos fondos agrupan empresas de toda la industria global de energía limpia—solar, eólica, servicios públicos y más—en una sola inversión. Esto permite a los inversores obtener exposición a un tema de rápido crecimiento sin analizar cada acción una por una.

Ejemplos populares incluyen:

-

ICLN – iShares Global Clean Energy ETF: Posee una amplia gama de empresas de energía limpia en todo el mundo, incluyendo solar, eólica y servicios públicos.

-

TAN – Invesco Solar ETF: Se centra específicamente en empresas de energía solar.

-

QCLN – First Trust NASDAQ Clean Edge Green Energy Index Fund: Combina acciones de energía limpia con empresas tecnológicas en baterías y energía alternativa.

Estos ETF son muy adecuados para la inversión a largo plazo, especialmente a medida que la transición global hacia la energía limpia se convierte en una tendencia dominante. Proporcionan una forma de construir una cartera orientada al crecimiento y sostenible para el futuro.

|

Consejo: Aunque las acciones de energía limpia muestran un fuerte potencial de crecimiento, siguen siendo altamente volátiles debido a factores como los costos de materias primas (litio y silicio), los cambios en las políticas gubernamentales y la intensa competencia tecnológica. Los traders que busquen especular en este sector deben apoyarse en herramientas técnicas, análisis de sentimiento y seguir de cerca las noticias relacionadas con la energía para cronometrar con mayor precisión sus entradas y salidas.

|

¿Son el Cripto y los Tokens de Energía Limpia el Futuro de Esta Industria?

Aunque aún son pequeños en comparación con el mercado de valores, algunas empresas de energía limpia han comenzado a experimentar con blockchain y tokens para aumentar la transparencia y permitir el comercio de energía local. Ejemplos incluyen:

-

Power Ledger (POWR): Una plataforma australiana que permite a las comunidades comerciar energía directamente entre sí

-

WePower (WPR): Un sistema para vender energía por adelantado mediante la tokenización

Estas tecnologías podrían convertirse en un motor positivo para las empresas de energía limpia en el futuro, ayudando a reducir costos y mejorar el acceso de los consumidores.

Cómo Empezar a Invertir en Energía Limpia

-

Inversión a Largo Plazo en Acciones de Energía Limpia

Empresas como Tesla y Enphase Energy siguen siendo populares entre los inversores a largo plazo, gracias a la expansión continua del mercado y a innovaciones como los sistemas de almacenamiento de alta eficiencia.

-

Uso de DCA para Mitigar la Volatilidad

El Dollar-Cost Averaging (DCA) ayuda a reducir el impacto de las oscilaciones del mercado al invertir una cantidad fija regularmente en acciones o ETF de energía limpia. Esta estrategia distribuye el riesgo mientras construye rendimientos estables a largo plazo.

-

Bonos Verdes: Invertir en un Futuro Sostenible

Los Bonos Verdes, emitidos por gobiernos u organizaciones privadas para financiar proyectos que reduzcan las emisiones de carbono, ofrecen tanto rendimientos estables como la posibilidad de apoyar objetivos ambientales.

-

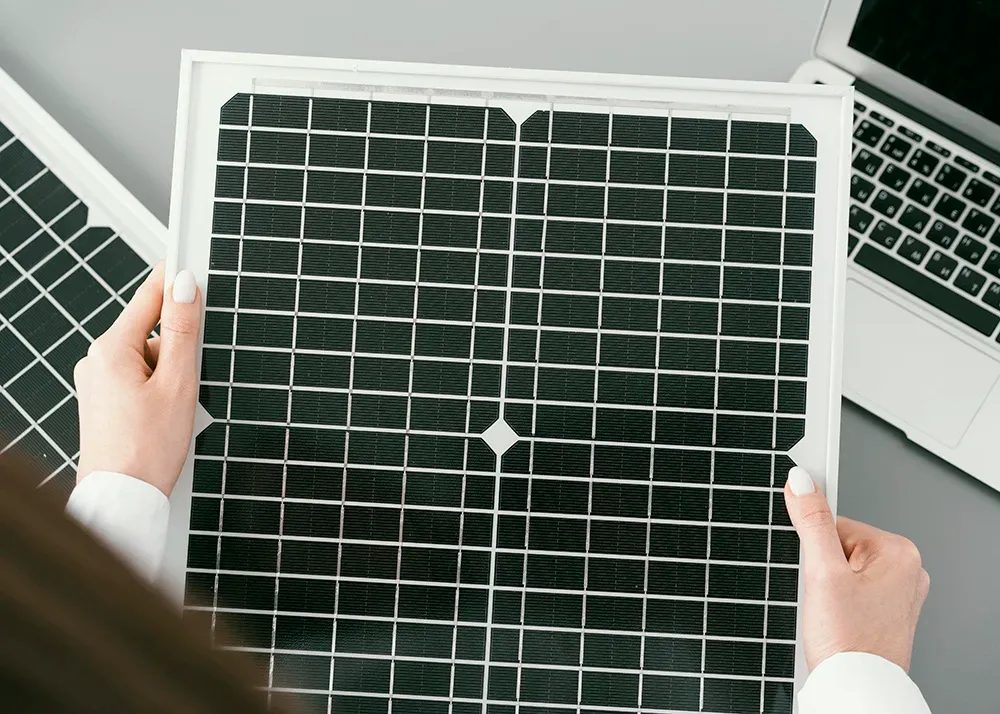

Comercio de Plata a través de CFD

La plata no solo es un metal precioso financiero, sino también un material clave en la industria de la energía limpia—especialmente en los paneles solares, donde desempeña un papel crucial en la conducción de electricidad. A medida que aumenta la demanda global de energía solar, la demanda de plata también crece. Operar XAG/USD a través de CFD se ha convertido en otra forma de capturar oportunidades vinculadas a la megatendencia de la energía limpia.

Paneles Solares y el Papel Crítico de la Plata

Principales Desafíos en la Inversión y el Comercio de Energía Limpia

-

Volatilidad de Precios: Las acciones de energía limpia y las materias primas relacionadas tienden a ser muy volátiles, impulsadas por políticas gubernamentales y la fluctuante demanda global.

-

Infraestructura Incompleta: Aunque el sector está en expansión, los sistemas de almacenamiento de energía y las redes eléctricas aún están en desarrollo en muchas regiones, lo que limita una adopción más amplia.

-

Competencia Intensa en el Mercado: La creciente popularidad ha llevado a una competencia feroz. Las empresas que no pueden innovar lo suficientemente rápido corren el riesgo de perder cuota de mercado frente a competidores más ágiles.

¿Es la Energía Limpia Solo una Tendencia—o el Verdadero Futuro de la Inversión?

La energía limpia ya no es solo una elección empresarial con beneficios ambientales—se ha convertido en una necesidad para construir un mundo sostenible. Invertir en acciones de energía limpia, ETF y bonos verdes permite a los inversores generar rendimientos a largo plazo mientras apoyan prácticas comerciales que reducen el impacto ambiental.

De cara al futuro, el mercado de la energía limpia seguirá siendo un foco clave para los inversores, impulsado por la innovación continua, el fuerte apoyo gubernamental y los cambios en el comportamiento del consumidor. Aquellos que se adapten a estos cambios podrán aprovechar la oportunidad de lograr rendimientos atractivos mientras contribuyen a un futuro más sostenible para el planeta.

💡Preguntas Frecuentes (FAQs)

P: Si no quiero elegir acciones individuales, ¿cómo puedo empezar a invertir en energía limpia?

R: Los inversores pueden comenzar a través de ETF de energía limpia como ICLN o TAN, que agrupan a las principales empresas del sector en un solo fondo. Esto ayuda a diversificar el riesgo y es adecuado para mantener a largo plazo.

P: ¿El comercio de plata (XAG/USD) realmente está relacionado con la energía limpia?

R: Sí. La plata es un material clave en los paneles solares, lo que convierte al comercio de XAG/USD en una forma de especular sobre un activo directamente vinculado a la tendencia de la energía limpia.

P: ¿Las acciones de energía limpia son mejores para el trading a corto plazo o para mantener a largo plazo?

R: Ambas opciones son posibles. El trading a corto plazo requiere estar atento a la alta volatilidad derivada de los cambios en políticas y costos de materias primas, mientras que mantener a largo plazo es ideal para los inversores que creen en la tendencia de Cero Neto y utilizan DCA para construir rendimientos estables.

Nota: Este artículo tiene únicamente fines educativos preliminares y no está destinado a proporcionar asesoramiento de inversión. Los inversores deben realizar investigaciones adicionales antes de tomar decisiones de inversión.